Table of Content

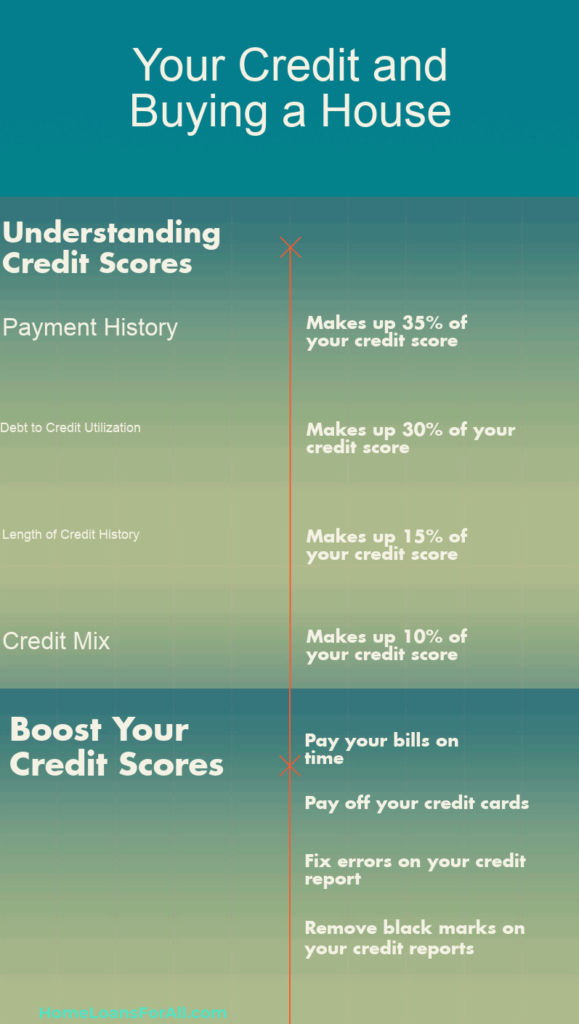

If this will help your credit score, you should ask to have this agreement made in writing so you can make sure it is removed when you pay. In order to get stellar credit, it will make sense to work on this aspect of your finances. By keeping your credit card debt low, you can really improve your scores. If you have a high credit score, you will have more options for a mortgage.

All lenders have specific lending criteria that must be met; it's their way of protecting themselves against loss. We do not offer or have any affiliation with loan modification, foreclosure prevention, payday loan, or short term loan services. Neither FHA.com nor its advertisers charge a fee or require anything other than a submission of qualifying information for comparison shopping ads. We encourage users to contact their lawyers, credit counselors, lenders, and housing counselors. The mix of different types of credit counts as 10% towards the score. They want to see a range of different credit, like credit cards, car payments, and other types of loans.

Ways to Buy a Home with Bad Credit

Even though you are already applying for a loan, you should be working toward improving your credit standing. By improving your credit score, you can refinance at some point in the future into more favorable terms. Credit reports compile information they get from credit bureaus, which are companies to which creditors report borrower payment history on a regular basis. Local banks, credit unions, and specialized mortgage lenders are often more flexible than big-name banks. Just note, many VA loan lenders require a minimum score of 580 or 620, despite the VA’s lenient rules. So shop around and ask lenders whether they’ll consider non-traditional credit history.

The qualifications of this loan can vary from county to county and household size. Partner with a trusted mortgage lender or visit the USDA website for more eligibility requirements. Benefits of this loan are zero down payment and low-interest rates. Another strategy is to reduce your total debt now and increase your income. This will improve your debt-to-income ratio, another critical metric lenders look at when making a lending decision.

An FHA Loan Is The Best Choice For First Time Buyers

If you are thinking about taking one of these loans, make sure you can really afford the payments. Some banks offered so-calledChristmas savings clubs, in which customers could make automatic deposits throughout the year that they could use for gifts at the end. To ensure that accounts were not raided early, there were financial penalties for early withdrawals. These penalties were then distributed to people who waited longer for their savings.

This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. As a first-time home buyer, you generally have less life experience than a person who has previously owned homes.

Good loan programs for buyers with bad credit

FHA loans let you put down as little as 3.5% if you have a credit score of 580 or higher. However, you may still be able to get a loan with a credit score of at least 500 — but you’ll likely need to make a 10% down payment. FHA loans also require you to pay a mortgage insurance premium. For instance, you may offer to put more toward your down payment, which reduces the size of the mortgage you need — and the lender’s risk.

Qualifying for a mortgage with no credit is all about working with a lender that will allow you to prove your creditworthiness in a way that is less dependent on a credit score. This change also allows you to establish an even stronger payment history on your credit report. It usually takes less than 30 – 45 days to see the effects of adding bulk, new accounts to your report. This is most often referred to as your “average age of accounts” and is one of the few factors you have almost no control over. Your credit history is basically the age of your oldest credit account, new credit accounts and the average ages of all the accounts on your credit report.

What is a bad credit score?

Whether you just bought a home or have owned your home for some time, there are many things you can do to save money for years to come. A below-market interest rate is an interest rate lower than that currently being offered for commercial loans extended by banks. A home mortgage is a loan given by a bank, mortgage company, or other financial institution for the purchase of a primary or investment residence.

And though she finds the color orange unflattering on most people, she thinks they'll enjoy Champaign tremendously. The amount of credit you are currently using is also known as your credit utilization and is responsible for 30% of your score. The more credit you’re using, the higher your credit utilization, the lower your score can become.

In addition to being recognized as one of the best real estate blogs, Kyle has been recognized as one of the top Realtors on social media by several organizations and websites. Sign up for a credit improvement service such as Credit Karma or Credit Sesame. Both are excellent companies that can speed up improving your credit standing.

Except, as a first-time home buyer, you have no recent mortgage payment history. Because a credit score of 500 is required to get mortgage-approved, only 5% of U.S. consumers would be mortgage-ineligible based on their credit score alone. The reality, though, is that you don’t need a high credit score to get home loan-approved — and your rates can still be great. The owner will keep the title until you refinance the house a few years later and the title is turned over to your new mortgage lender. One fact that makes credit scores a bit confusing is that there are so many of them. These numbers are generated by credit scoring agencies and financial institutions.

No comments:

Post a Comment